Ever go into the convenience store and use their “take a penny – leave a penny” bin? Not anymore. Find a penny, pick it up? Those days are numbered too.

For generations, the humble one-cent coin — the penny — has jingled in pockets, piggy banks and cash registers. Now the U.S. is moving toward a new era in its coinage. Production of the penny is officially being halted, and this shift raises questions about how merchants, consumers and small transactions will adapt.

A brief history of the penny and efforts to retire it

The U.S. penny (the one-cent coin) has roots that trace back to the earliest years of the U.S. Mint, following the Coinage Act of 1792. Over time it has become less relevant as inflation eroded its purchasing power.

Efforts to eliminate or reduce reliance on the penny have been around for decades. One of the earliest formal legislative efforts: in 1989, Rep. Jim Kolbe (R-Arizona) introduced the Price Rounding Act of 1989 (H.R. 3761) which would have removed one-cent pieces from cash transactions and required rounding to the nearest five cents. Kolbe subsequently introduced other bills: the Legal Tender Modernization Act in 2001 (H.R. 2528) and the Currency Overhaul for an Industrious Nation (COIN) Act in 2006 (H.R. 5818) to modernise U.S. currency and reduce penny use.

In recent years the debate intensified, noting that the penny costs more to make than its face value. In May 2025 the United States Treasury Department announced that the penny’s production would cease for circulation beginning with the 2026 production run. On November 12, 2025, the United States Mint struck a ceremonial “final” circulating penny at its Philadelphia facility.

Costs of minting coins – the penny and its neighbors

One of the biggest arguments for ending penny production is cost. Here’s a snapshot of how much various U.S. coins cost to mint (and dispatch) in recent years:

- The penny (1 ¢ coin) costs approximately 3.69 cents to produce and distribute.

- The nickel (5 ¢ coin) figures also show it cost more than its face value: around 13.78 cents in recent data.

- The dime (10 ¢ coin) costs about 5.76 cents to make/distribute.

- The quarter (25 ¢ coin) costs about 14.68 cents to make/distribute (in FY2024).

- The half-dollar (50 ¢ coin) costs roughly 33.97 cents to produce.

In short: the penny has long cost more than its face value to produce, meaning each penny minted represents a loss.

How will merchants price and give change without the penny?

With the penny no longer being newly minted for circulation (though existing pennies remain legal tender), the key question: how will retail prices, tax calculations and change-making adapt?

Here are some of the likely developments and considerations:

- Rounding of cash transactions

With pennies absent or greatly reduced in circulation, many expect cash transactions to be rounded to the nearest five cents (i.e., nearest nickel) for the total amount. This approach has precedent in other countries. For example: if your total bill is $10.02 or $10.03, it might be rounded down to $10.00; if it’s $10.04 or $10.05, it might be rounded up to $10.05. The exact practice would vary by locale and business policy. - Listed prices remain in cents

Even though cash change might be rounded, retailers can still list prices to the cent (e.g., $19.99). The rounding happens only at the point of payment for the cash transaction. Non-cash payments (credit/debit, mobile) can still settle exact cents amounts, since internal accounting systems handle fractions of a dollar. - Taxation and receipts

Sales tax calculations still occur at full precision (to the cent) and businesses will need to maintain accounting integrity. The rounding applies at the final tender stage for cash only. Tax authorities and businesses will issue guidance to ensure consistency. - Merchant-strategy and consumer confidence

Merchants may publicize their rounding policy (“We round cash totals to the nearest nickel”) to avoid consumer surprise. Some may choose to round down as a goodwill gesture or to avoid perception of “nickel-and-diming.” Research (for example by economists referenced in the Federal Reserve Bank of Richmond) suggests rounding has minimal long-term inflationary impact. - Impact on change machines and coin-handling

Vending machines, coin-operated laundries, and other coin-heavy segments may see adjustments. Fewer pennies moving means coin tubs, tills and change-making racks will be re-calibrated for nickels as the smallest coin. Some machine manufacturers may adapt to dispense nickels as the lowest change unit.

What happens to the pennies already circulating?

Existing pennies remain legal tender; you can still use them in transactions. However, with no new pennies minted for circulation, their circulation will gradually decline (people hoard them, roll them, deposit them). Over time pennies may simply fade from everyday use.

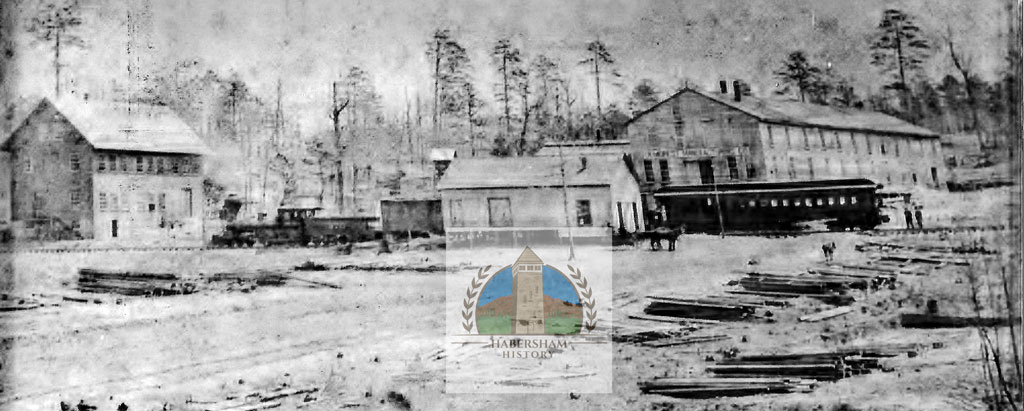

Local perspective: what this means for Habersham County and community merchants

In Habersham County, where local businesses, farmers markets and small-town stores still use cash frequently, here are some key takeaways:

- Merchants should update their point-of-sale systems (or cash register training) to reflect any new rounding policy and communicate to staff and customers.

- School fund-raisers, charity drives and penny-collection jars (a familiar tradition) may shift focus — charities that rely on rounding up pennies will need to decide how to adjust (for example, collecting rolled nickels instead).

- The impact on residents is likely minimal, but during the transition there may be short-term confusion (e.g., “Why didn’t I get a penny back?”). Clear signage and consumer education will help.

In summary

The penny’s days as a circulating coin have effectively ended: production has been halted, the cost to make the penny far exceeds its value, and the system is shifting toward rounding of cash totals. For consumers and merchants alike, the change is more gradual than dramatic — price tags stay the same, cards and digital payments remain unaffected, and pennies will still work. But for small-change transactions and coin handling, a new era is here.

As Habersham County continues to embrace local commerce and civic awareness, keeping the community informed about how everyday transactions may shift by a few cents will help smooth the transition.